Modern Treasury: Improving the way businesses move and track money

Salesforce Ventures believes in modernizing outdated business infrastructure. That is why we are proud to announce that Salesforce Ventures is investing in Modern Treasury.

Today, many companies throw people at the problem. They hire people to handle payments; engineers to build bank integrations; and finance people to send checks and wires, reconcile payments, and close the books each month. This poor experience is primarily driven by the infrastructure that facilitates these transactions, which is arcane, slow, mostly manual, and difficult to integrate into.

Despite this poor user experience, the volume and dollar value that moves through the ACH network is staggering. According to the National Automated Clearinghouse Association, the ACH network handled 29.1 billion payments in 2021, representing $73 trillion. Business transactions comprised 5.3 billion of those payments, representing a disproportionate $50 trillion in value — a 20% increase year-over-year. In addition, Fedwire, a real-time gross settlement system of central bank money used by Federal Reserve banks, estimates that 204.5 million transfers were initiated in 2021, representing $992 trillion.

Finally, an automated solution to payments

Modern Treasury automates much of the process of moving and tracking money for businesses. The company created an application programming interface, or API, which integrates with the banking system, and built software to make the tracking easier for finance and treasury teams. This automation enables companies to build and scale innovative products, manage payments via a dashboard, and automatically reconcile cash across multiple bank accounts.

Salesforce Ventures believes in modernizing outdated business infrastructure. That is why we are proud to announce that Salesforce Ventures is joining Altimeter Capital, Benchmark, Y Combinator, and SVB Capital in investing in Modern Treasury.

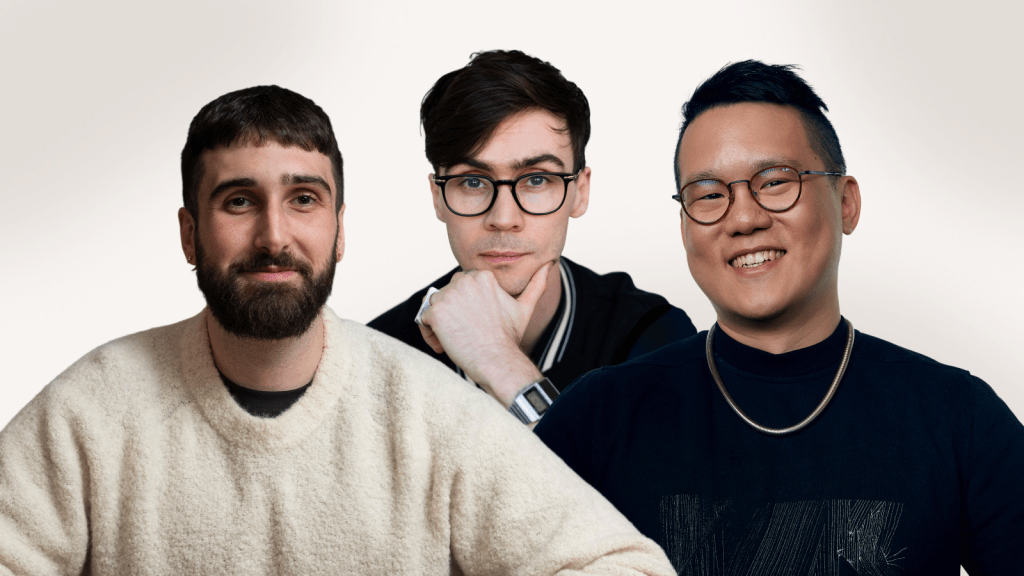

Modern Treasury was founded in 2018 by Dimitri Dadiomov (CEO), Sam Aarons (CTO), and Matt Marcus (CPO). The founders met at LendingHome, where they were responsible for the company’s payment operations. This included funding loans, collecting monthly payments, initiating investor deposits, handling transfers, and reconciling everything. Through their first-hand experience, they realized the inefficiency and waste of the manual and human-capital-intensive process of building tools to connect to banks, manage all of the money going out in the form of loans and coming back in monthly payments, and reconcile their books. When they began to see this as a universal problem, they recognized a massive opportunity and left to start Modern Treasury.

Today, Modern Treasury is one of the most innovative payments solutions on the market. The company brings a much-needed automated payment infrastructure to the business world. Its solution includes all the workflow around money movement to make those processes faster, more reliable, and more efficient.

The key enabler of the Modern Treasury product is its network of banks. The company has API connections with more than 25 banks today. By connecting to this network and providing a friendly user interface on top, they’re able to facilitate traditionally cumbersome processes like payment initiation, tracking and attributing sent and received funds, resolving payment failures and returns, and reconciling transactions to bank statements and the ledger.

Modern Treasury has capitalized on strong market tailwinds and achieved tremendous growth. Its customers reconcile more than $2.8 billion per month using the platform, up from $1 billion a year ago. Customers include fast-growing companies such as Gusto, TripActions, and Marqeta. Customers are driving more than $300 million in Real-Time Payments, or RTP, over the Modern Treasury platform per year. RTP is the first new payment rail in the U.S. in four decades.

We are thrilled to partner with Modern Treasury on their next chapter as they transform the way teams move and track money, catalyzing growth in the economy’s most important sectors, from real estate and healthcare to education and financial services. We hope you will join us in welcoming Modern Treasury to the Salesforce Ventures family!